Understanding Housing Affordability: Key Metrics and Statistics

Housing affordability is a significant concern in many parts of the world, affecting the quality of life and economic wellbeing of individuals and families.

Professor Nicole Gurran from the School of Architecture, Design and Planning says governments around the world are searching for solutions to fix housing affordability, with two opposing schools of thought seeing the solutions as:

- Increasing supply. Those in support of this point of view see housing as more expensive because there’s not enough new supply. They see land use regulation and planning processes as restrictive to new construction, adding costly delays and uncertainty to the development process.

- On the flipside, others argue that ‘demand side’ factors underlying global house price inflation, such as low cost credit under financial deregulation, or government incentives to encourage property investment are being ignored. They highlight the political influence of property industry groups sustaining housing demand while advocating for reduced regulations. Some even suggest that extensive rezoning reforms may trigger surges in redevelopment and gentrification, potentially displacing individuals with lower incomes.

To truly understand the dynamics of housing affordability we need to take a detailed look at a range of different metrics and statistics to gain a full picture.

Shedding light on these crucial measures can offer insights for homebuyers, policymakers, real estate professionals, and urban planners.

1. Median and Average Home Prices

These figures provide a baseline for understanding the cost of purchasing a home in a particular area.

The median home price provides a middle point and the average home price presents an overall trend.

2. Price-to-Income Ratio

This critical ratio compares home prices to average household incomes. A higher ratio suggests that homes are less affordable relative to income.

Statista has published the the house price-to-income ratio in Australia as 122.1 as of the third quarter of 2024. This ratio is calculated by dividing nominal house prices by nominal disposable income per head and has increased from the previous quarter.

3. Housing Affordability Measures

A Housing Affordability Index (HAI) assesses whether a typical family can afford the mortgage on a median-priced home, based on their income. An index above 100 indicates greater affordability.

The issue with the HAI is that it primarily focuses on purchase affordability.

The Australian Institute of Health and Welfare (AIHW) broadens what they classify as housing costs in measuring housing affordability.

AIHW defines housing costs as “the sum of rent payments, rate payments (water and general), and housing–related mortgage payments”,

AIHW expresses housing affordability as “the ratio of housing costs to gross household income”,

While housing stress is typically described as “lower-income households that spend more than 30% of gross income on housing costs“.

The second measure is a more comprehensive approach which considers a range of housing costs, the complexity of housing affordability and its impact on households.

4. Rent-to-Income Ratio

Rent-to-Income Ratio compares a tenant’s monthly rent to their gross monthly income expressed as a ratio. For those in the rental market, this ratio measures how much of a household’s income is spent on rent, with higher values indicating less affordability.

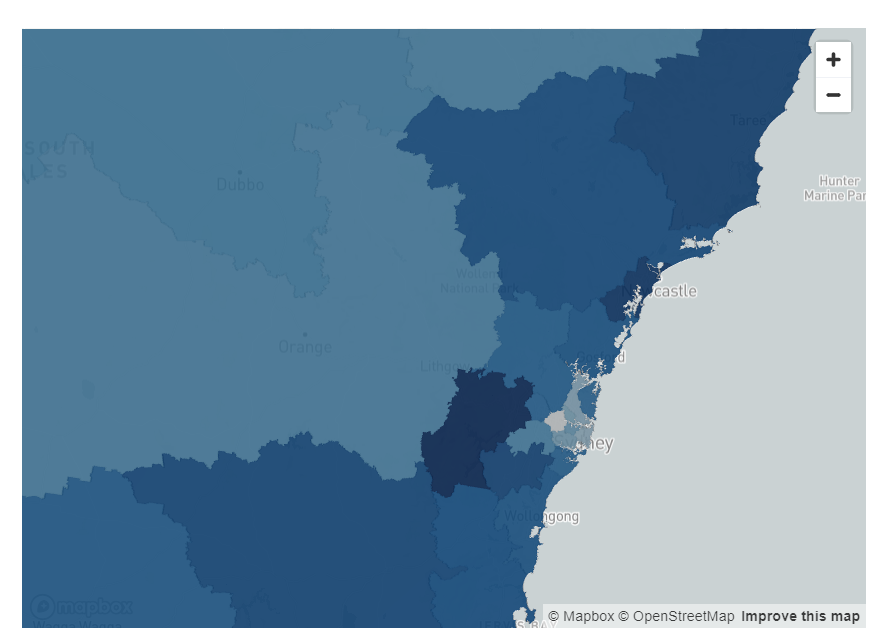

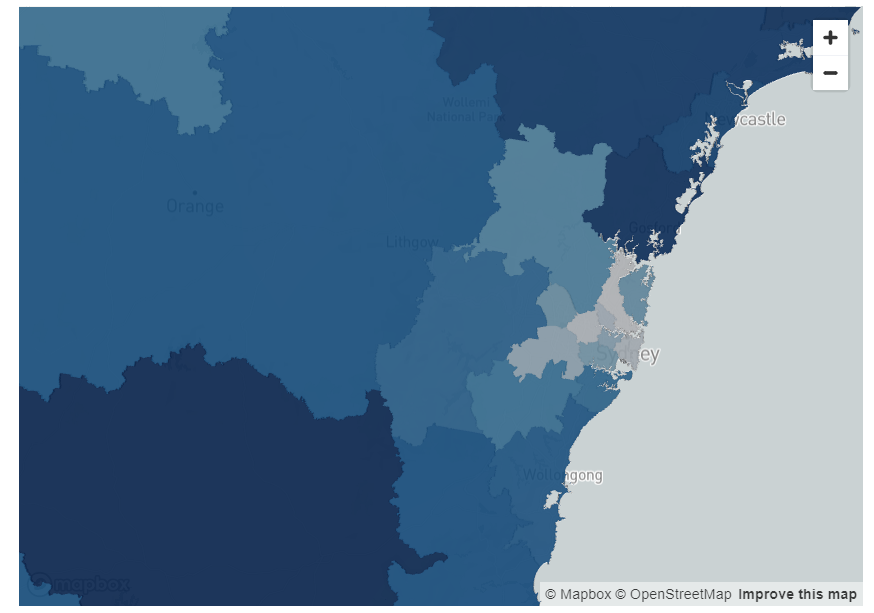

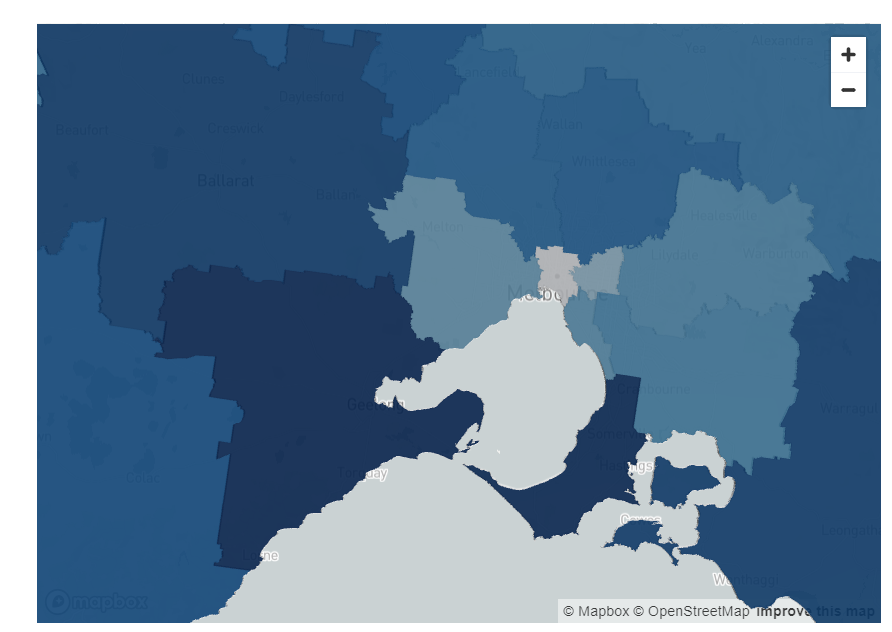

PropTrack classifies unaffordable rental housing as a household spending more than a quarter of their pre-tax income on rent. PropTrack recently released its 2025 Rental Affordability Report, and renters are facing the toughest conditions seen in Australia.

5. Mortgage Interest Rates

Interest rates directly affect the cost of borrowing money for home purchases.

An increase in mortgage interest rates typically mean an increase in mortgage repayments, which can negatively impact affordability.

While a reduction in rates typically means reduced mortgage repayments, which may improve affordability.

6. Mortgage Payment as a Percentage of Income

Mortgage payment as a percentage of income is an important measure of affordability by demonstrating the burden of mortgage payments relative to a household’s income.

This percentage is calculated by dividing monthly mortgage repayments by gross monthly wages.

The recommended figure is 28% of pre-tax income. Or in other words, no more than 28% of gross monthly income should go towards monthly mortgage repayments.

7. Homeownership Rates

Broad changes in homeownership rates can signal shifts in affordability, and the overall health of the housing market.

To gain an idea of homeownership rates in Australia, AIHW shares a view of Home ownership and housing tenure in Australia.

8. Cost of Living

Several measures are published to calculate and help gauge changes in the cost of living. Changes in cost of living impacts our household purchasing power and has implications for housing demand.

The main ways we measure cost of living is the Consumer Price Index.

Consumer Price Index (CPI)

According to the Australian Bureau of Statistics, CPI is a measure of the average change over time in the prices paid by households for a fixed basket of goods and services (which is grouped into 11 categories: Food and non-alcoholic beverages, Alcohol and tobacco, Clothing and footwear, Housing, Furnishings, household equipment and services, Health, Transport, Communication, Recreation and culture, Education, and Insurance and financial services).

It’s important to note that the calculation of CPI does not include the cost of buying established dwellings, nor mortgage repayments. However, it does include rents, the cost of new dwellings (excluding value of land) and major alterations and additions to dwellings.

Included in CPI | Not included in CPI |

|

|

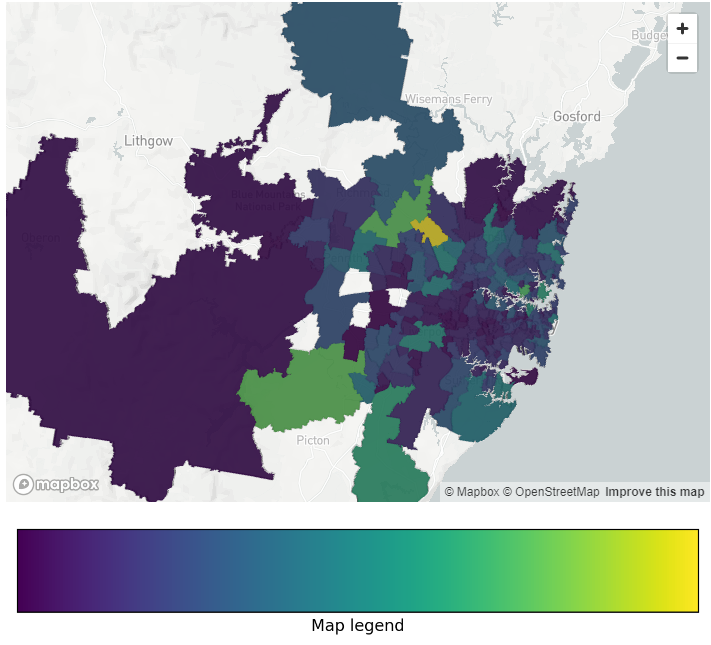

9. Gini Coefficient of Home Prices

The Gini Coefficient statistical measure is typically used as a measure of income inequality, although it can be used to assess inequality in various other contexts, including home values in a real estate market.

A Gini index of 0 represents perfect equality, while an index of 100 implies perfect inequality.

This measure can indicate the inequality in home values within a market, with higher values suggesting greater disparity.

10. Building Permits and Housing Starts

Building permits and housing starts are indicators of building activity and housing supply. They can signal future market changes which may impact affordability.

The Proptech Cloud publishes ready-to-use Construction Activity data from the Australian Bureau of Statistics on the Snowflake Marketplace.

11. Vacancy Rates

A vacancy rate is a measure of the percentage of all rental properties that are currently vacant and available for rent.

Fluctuations in vacancy rates can impact rental prices, as elevated rates often correlate with decreased rents, and conversely, lower vacancy rates may lead to higher rental prices.

12. Debt-to-Income Ratio

An individual’s Debt-to-Income Ratio is calculated by taking their total monthly debt and dividing it by their monthly income.

This ratio reflects a person’s capacity to afford housing in light of their existing debts.

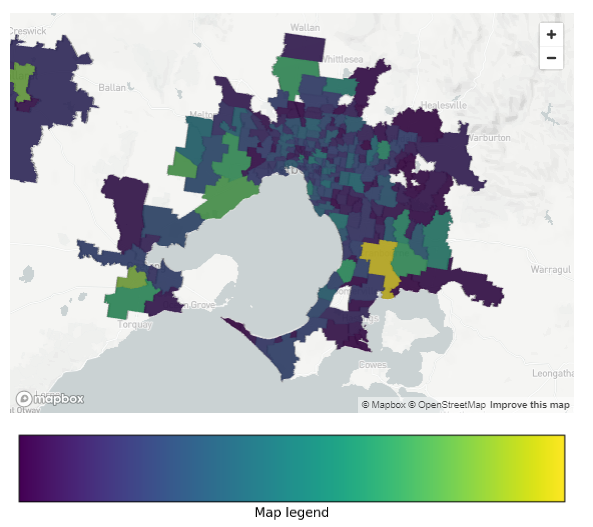

14. Population Growth and Urbanisation

Rapid population growth or accelerated urbanisation can significantly drive up housing demand, often outpacing the supply of available homes. This increased competition for housing can lead to rising property prices and rental costs, making affordability a growing concern, particularly in high-demand urban centres.

Additionally, infrastructure, public services and planning regulations may struggle to keep pace with rapid expansion, further exacerbating affordability challenges. Understanding these dynamics is crucial for policymakers, developers, and investors looking to create sustainable housing solutions..

A Multifaceted View of Housing Affordability

This diverse set of metrics can collectively provide a comprehensive perspective on housing affordability by capturing the various factors that influence pricing while revealing the complexities of the housing market.

These indicators are vital for informed decision-making, policy development and market analysis.

Regularly tracking these metrics allow stakeholders to spot emerging trends, assess market stability and make data-driven decisions.

For those navigating the housing sector, staying informed on these indicators can allow them to anticipate shifts, mitigate risks and capitalise on opportunities in dynamic market.

Originally published: 18 January, 2024

Last updated: 11 March, 2025

Subscribe to our newsletter

Subscribe to receive the latest blogs and data listings direct to your inbox.