Useful Websites for Australian Properties, Parcels and Addresses

Researching whether a property exists or verifying property data can be challenging, often resulting in conflicting answers.

Depending on your definition of a property, it may be necessary to visit various websites to validate property data.

Here we’ve rounded up the top websites handy for verifying property data in each Australian state.

Save time by bookmarking this resource and avoid the hassle of constantly searching online.

Australian Capital Territory (ACT)

Access Canberra

Website: https://actlis.act.gov.au/titleSearch

Available searches: title search, parcel search, address search.

Available information: parcel, title, address, title status

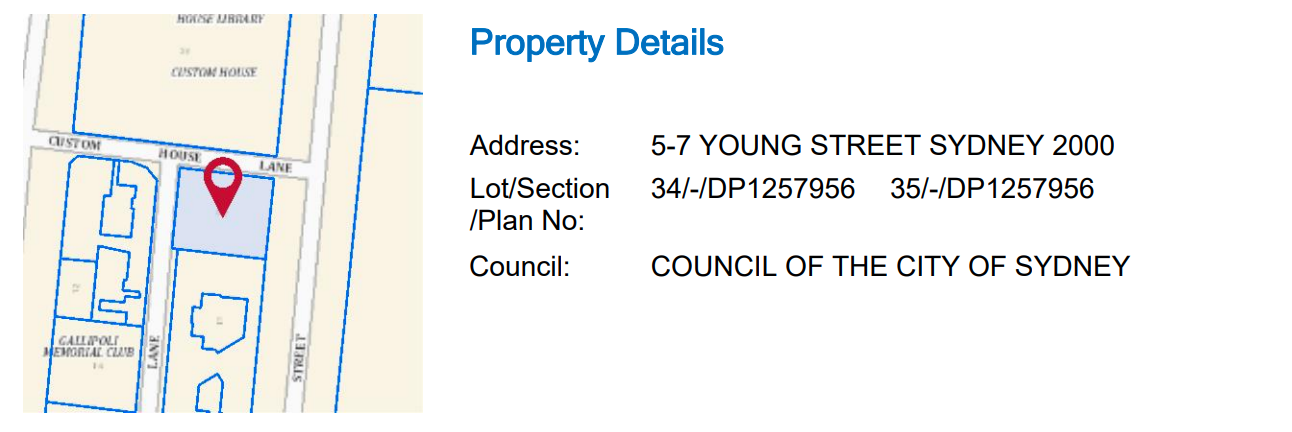

New South Wales (NSW)

NSW LRS Online

Website: https://online.nswlrs.com.au/wps/portal/six/find-records/

Available searches: title search, parcel search, address search.

Available information: parcel, title, address, parcel boundary

ePlanning Spatial Viewer

Website: https://www.planningportal.nsw.gov.au/spatialviewer/#/find-a-property/address

Available searches: parcel search, address search.

Available information: parcel, address, parcel boundary, planning rules, council/county/jurisdiction

Northern Territory (NT)

Northern Territory Title Search

Website: https://www.ntlis.nt.gov.au/title-search/

Available searches: title search, parcel search, address search.

Available information: parcel, title, address, title status

Queensland (QLD)

Queensland Globe

Website: https://qldglobe.information.qld.gov.au/

Available searches: parcel search, address search, spatial search

Available information: parcel, parcel boundary, title, address, title status, tenure

South Australia (SA)

Sailis Land Services SA

Property Research Report (Residential)

Website: https://sailis.lssa.com.au/products/valuationSearch/prr/propertyResearchReportResidential?form

Available searches: address, title, parcel, valuation

Available information: parcel, title, address, valuation status

Tasmania (TAS)

Land Information System Tasmania

Website: https://maps.thelist.tas.gov.au/listmap/app/list/map

Available searches: address, property id, title, volume folio

Available information: parcel, parcel boundary, parcel identifier, address, property

Victoria (VIC)

Landata

Website:

https://www.landata.vic.gov.au/

Available searches: address, property id, standard parcel identifier, volume folio

Available information: address, property , volume folio, standard parcel identifier

Western Australia (WA)

Landgate – Western Australia’s land information authority

Website: https://www0.landgate.wa.gov.au/

Available searches: address search, lot plan, volume folio

Available information: address, volume folio, standard parcel identifier

Originally published: 24 April 2023

Last updated: 17 March 2025