GLOBAL

Asset-Level Location Intelligence

From Spatial Risk Systems

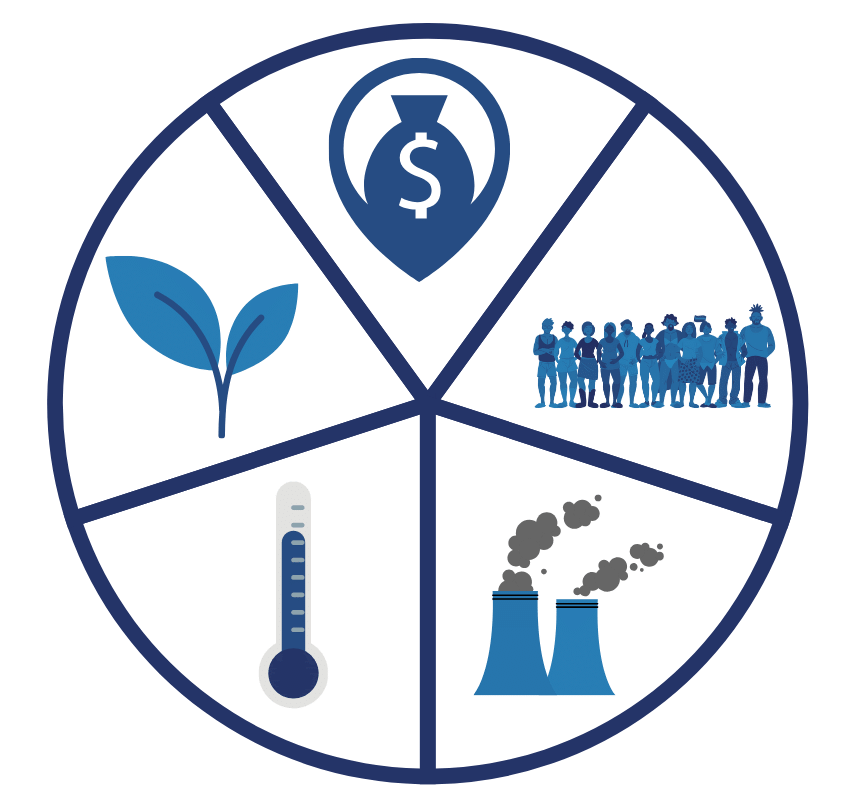

Asset-Level Location Intelligence from Spatial Risk Systems connects and standardises dozens of data sources into a single publishing solution. This asset-level Reference Data Layer has five major data dimensions.

Data Overview

Spatial Risk Systems (SRS), the market leader for asset-level location intelligence, has engineered a cloud-based data network known as a Knowledge Graph, which connects and standardises dozens of asset-level data sources into a single publishing solution.

This asset-level Reference Data Layer has Five Major Data Dimensions:

- Global Asset Location, Function, and Ownership with links to existing financial identifiers fully supported (i.e., Ticker, CUSIP, ISIN, FIGI, etc..)

- Climate

18 Natural Disaster Risks

Expected Annual Losses (EAL)

1.8 million Weather Events and Financial Impacts - Carbon Emissions/Accounting

Scope I (Direct Emissions)

Scope II (Indirect Emissions)

Social Costs of Carbon - Environmental

Toxic Releases

Air and Water Quality Measures

Toxic Storage Site Proximity - Socio-Economic

Community Vulnerability-Related Factors

Community Resiliency-Related Factors

Cloud Region Availability

US West (Oregon)

Canada (Central)

US East (N. Virginia)

US East (Ohio)

US East (Commercial Gov - N. Virginia)

US Gov East 1 (Fedramp High Plus)

US Gov West 1

US Gov West 1 (DoD)

US Gov West 1 (Fedramp High Plus)

Asia Pacific (Jakarta)

Asia Pacific (Mumbai)

Asia Pacific (Osaka)

Asia Pacific (Seoul)

Asia Pacific (Singapore)

Asia Pacific (Sydney)

Asia Pacific (Tokyo)

EU (Frankfurt)

EU (Ireland)

EU (London)

EU (Stockholm)

EU (Zurich)

EU (Paris)

South America (São Paulo)

Canada Central (Toronto)

Central US (Iowa)

East US 2 (Virginia)

South Central US (Texas)

US Gov Virginia

US Gov Virginia (FedRAMP) High Plus

West US 2 (Washington)

Australia East (New South Wales)

Central India (Pune)

Japan East (Tokyo, Saitama)

Southeast Asia (Singapore)

UAE North (Dubai)

North Europe (Ireland)

Switzerland North (Zurich)

UK South (London)

West Europe (Netherlands)

US Central 1 (Iowa)

US East 4 (N. Virginia)

Europe West 2 (London)

Europe West 4 (Netherlands)

Category

Geospatial

Refreshes

Quarterly

Access

Available on request

Geographic Coverage

Global (by Latitude and Longitude)