What’s The Difference Between Proptech and Contech?

In real estate and construction, proptech and contech have emerged in more recent years with the potential to disrupt and digitise.

These technologies are driving innovation across industries, yet they each serve distinct roles.

We uncover the nuances and distinctions between proptech and contech here.

Defining Proptech and Contech

Proptech

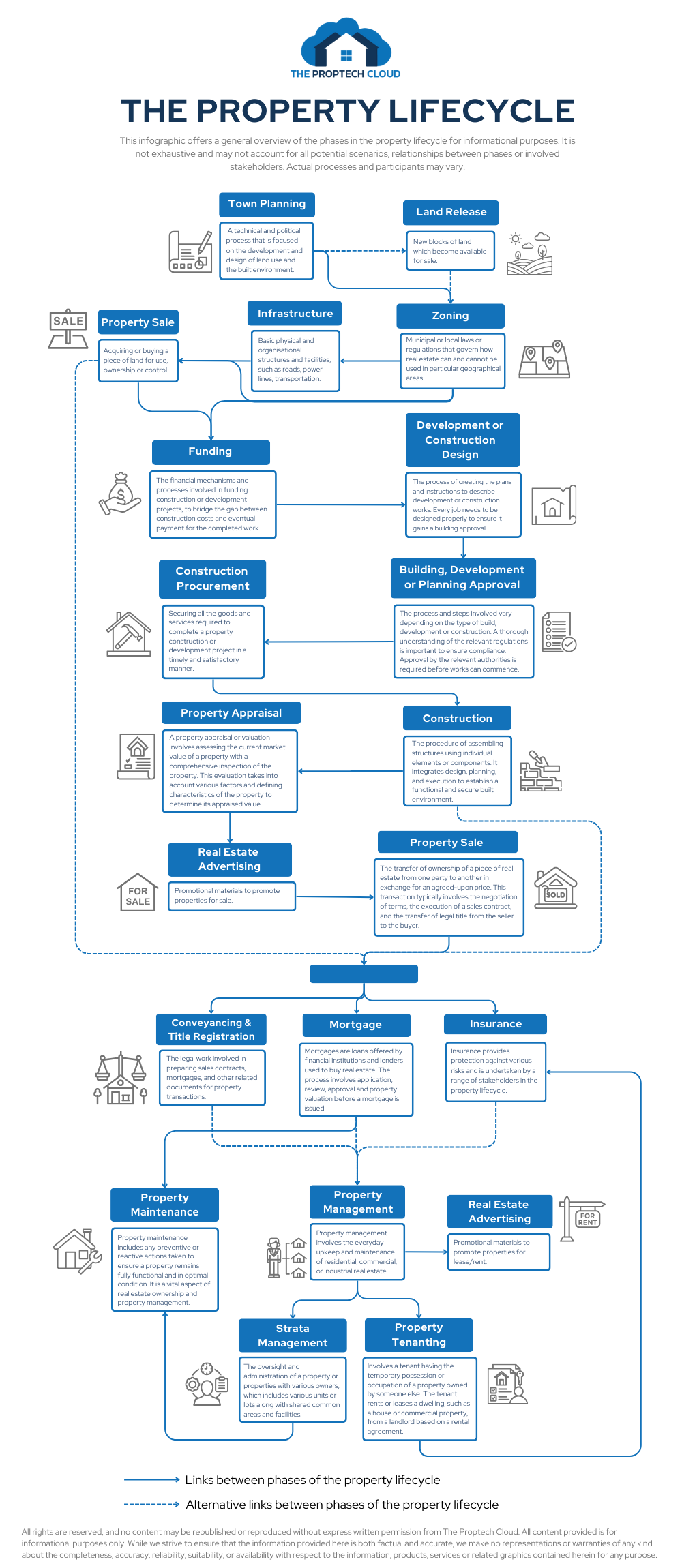

Proptech is the broad umbrella term encompassing all digital innovations that enhance and streamline processes within the real estate industry.

It covers everything from property management and transactions to marketing and customer engagement.

While its reach can extend to the construction phase of property development, proptech’s focus is on optimising the entire lifecycle of real estate—from conception to management.

Here are examples of startups and more established proptech companies making waves in real estate:

- Archistar specialises in AI-driven architectural design and property analytics, helping developers and architects assess building potential.

- Propic uses AI and machine learning to enhance real estate processes such as sales, property management and customer service automation.

- Little Hinges specialises in digital property marketing solutions with virtual property tours, floorplans, virtual staging, global platform and an Insights portal.

- Equiem provides tenant engagement technology for commercial real estate, focusing on improving communication and services between landlords and tenants.

- CoreLogic, a provider of financial, property, consumer information services known for their comprehensive real estate data services, is also a leading player in AI-powered housing data and analytics.

- AirBNB is well known as a short-term rental platform, however, Airbnb’s disruption and influence on the traditional property management and rental markets has defined its role in the proptech sector.

- Zillow is a comprehensive platform connecting renters, buyers and sellers to facilitate seamless transitions into their dream homes.

Contech

While proptech may briefly address construction, contech is solely focused on the construction process, providing solutions that improves safety, efficiency and/or precision on the job site. In general, it refers to the technologies that directly impact the planning, design and building of structures.

Here are some notable contech companies making an impact on the construction industry:

- Autodesk is known for their Design and Make Platform for planning, design, construction and project operation.

- Procore’s cloud-based construction management platform streamlines every process from pre-construction to closeout.

- Built Robotics has a mission to build the robots that build the world.

- Rhumbix is a software company which consolidates and digitises field reporting workflows into one app.

- Matterport is a spatial data company focused on digitising and indexing the built world with their all-in-one 3D data platform.

- cmBuilder offers 4D construction site logistics with fast & easy cloud-based workflows, powerful sequencing simulation capabilities, and unparalleled real-time collaboration.

Key Differences Between Proptech and Contech

Scope of Application:

- Proptech covers a broad spectrum of digital tools and platforms used across the real estate industry, including everything from smart property management systems to online marketplaces that simplify buying, selling, and renting properties.

- Contech is focused on the construction phase of property development. It involves tools and technologies that assist architects, engineers and builders in creating physical structures, from advanced construction materials to innovative design software.

Target Audience:

- Proptech primarily targets real estate professionals, including developers, property managers, realtors, investors, and tenants. Its tools are designed to enhance customer experiences, streamline transactions and provide valuable market insights.

- Contech caters specifically to construction professionals—architects, contractors, engineers, and construction workers— with a focus on improving the efficiency, safety and/or quality of the construction process.

Technological Impact:

- Proptech typically integrates technologies such as Big Data, Artificial Intelligence, Virtual and Augmented Reality, IoT and Blockchain. These innovations have the power to transform traditional real estate practices, offering smarter, more efficient ways to manage properties, conduct transactions and interact with clients.

- Contech typically leverages technologies like Building Information Modeling (BIM), prefabrication, robotics, drones or wearable tech. These tools are generally designed to enhance and optimise the construction process, reduce risks and improve productivity on-site.

Proptech and Contech: Better Together

While proptech and contech operate in different domains, their intersection is where the magic happens.

Proptech’s digital solutions often complement contech’s innovations, creating a seamless flow from project planning and construction to property management and sales.

For instance, a real estate developer might use contech to design and build a property, then rely on proptech platforms to market, lease or sell the units.

Proptech and contech both offer powerful tools that drive efficiency, safety and profitability in real estate and construction.

By leveraging these technologies, professionals can navigate industry complexities with greater agility and success.

At The Proptech Cloud, we believe in the game-changing power of both proptech and contech.

Together, they’re reshaping the future of real estate—one innovative solution at a time.

Subscribe to our newsletter

Subscribe to receive the latest blogs and data listings direct to your inbox.